Intel Stocks Plunge Amid Trump’s Public Rebuke of CEO

Market Shock: Intel Shares Plummet After Trump Targets CEO

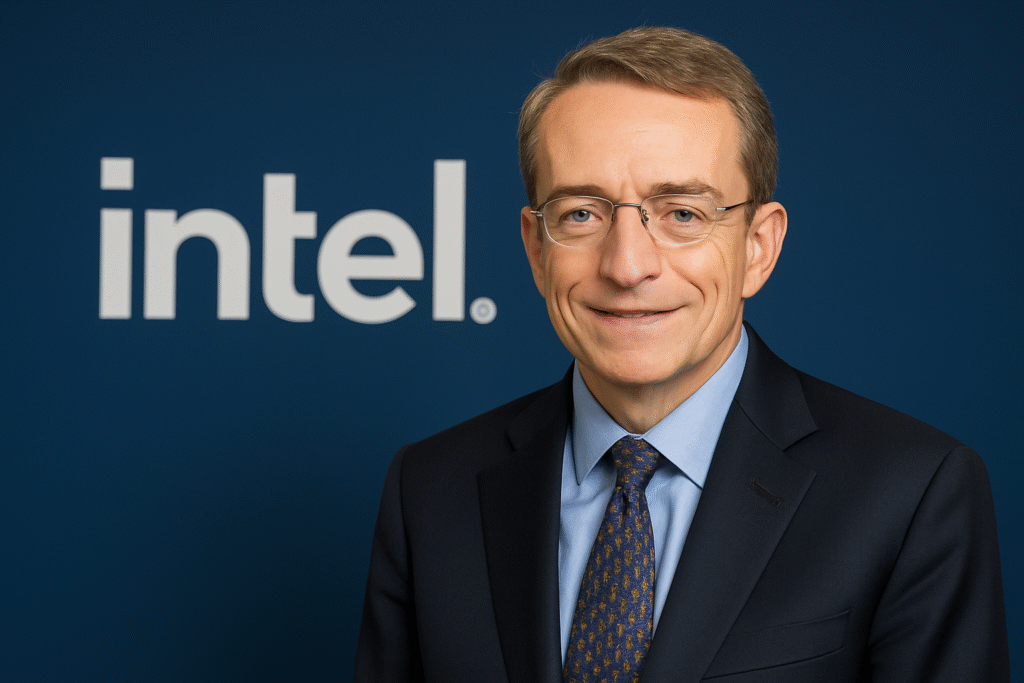

In a dramatic turn of events that sent shockwaves through Wall Street, Intel Corporation (NASDAQ: INTC) witnessed a sharp decline in its stock value after former President Donald Trump publicly criticized Intel CEO Patrick Gelsinger. The explosive remarks came during a campaign rally in Ohio, where Trump lambasted Intel’s leadership, calling it “weak,” “politically compromised,” and “a national liability.”

Within minutes of the former president’s comments going viral, Intel’s market cap shed billions, plunging nearly 9.3% by the close of the trading day. Investors and analysts scrambled to assess the long-term implications of Trump’s remarks, which many now believe could have a ripple effect across the broader semiconductor and tech industries.

Trump’s Explosive Comments on Intel’s Leadership

The former president did not mince words, accusing Intel of failing to maintain American dominance in the global chip race. During his fiery address, Trump stated:

“Intel’s CEO is a disgrace. Under his leadership, they’ve outsourced innovation, lost ground to Taiwan and South Korea, and are making weak deals with China. He’s not leading; he’s surrendering.”

Trump’s criticism centered around Intel’s global manufacturing strategy, its lag behind Taiwan Semiconductor Manufacturing Company (TSMC), and its recent diplomatic engagements in China. His words hit a nerve in a political climate already tense with discussions on national security, tech sovereignty, and global trade dynamics.

Investors React: Market Confidence Shaken

The reaction from investors was immediate and unforgiving. Within hours of Trump’s tirade, Intel’s stock dipped from $39.42 to $35.78, wiping out over $16 billion in shareholder value.

Traders cited concerns over potential political fallout, fears of regulatory scrutiny, and reputational damage as key drivers behind the sudden sell-off. “When someone with Trump’s influence slams a company like that, Wall Street listens—whether they agree with him or not,” said Mark Tindall, a senior analyst at Greystone Capital.

Wall Street Analysts Downgrade Intel Amid Political Uncertainty

Several major financial institutions, including Morgan Stanley and JPMorgan Chase, issued downgrades on Intel stock within 24 hours of Trump’s remarks. JPMorgan revised its rating from “neutral” to “underweight,” citing “increased political risk and deteriorating public perception.”

Goldman Sachs noted in a client memo that while Intel’s fundamentals remain stable, the brand damage from a political firestorm could “adversely affect long-term institutional confidence” and create “unnecessary noise” for shareholders.

Intel Responds: Defending Their Vision and CEO

“Intel remains deeply committed to American leadership in semiconductors. Under Mr. Gelsinger’s leadership, we have announced over $100 billion in investments in US-based manufacturing, including new fabs in Arizona and Ohio.”

Intel also emphasized their cooperation with the Biden Administration’s CHIPS and Science Act, showcasing their alignment with national priorities to restore the United States’ position in semiconductor supremacy.

Despite the statement, sentiment on social media remained divided, with some users rallying behind Trump’s stance while others defended Gelsinger’s strategic direction.

Political Influence on Tech Stocks: A Growing Trend

This episode further illustrates the increasing influence of political figures on financial markets, particularly in the tech and defense sectors. With semiconductors being central to national security and global economic power, companies like Intel are under heightened scrutiny from both sides of the political aisle.

As the 2026 presidential campaign heats up, experts warn that such public outbursts could become more common, with politicians leveraging their platforms to shape public opinion—and inadvertently, stock prices.

“Tech CEOs aren’t just leading companies anymore—they’re representing geopolitical interests,” said Carla Mendoza, a political risk consultant. “A negative comment from a major political figure can now trigger a multi-billion-dollar sell-off.”

Global Competitors Gaining Momentum

While Intel deals with the aftermath of Trump’s remarks, global rivals such as TSMC, Samsung, and NVIDIA continue to widen the gap in technology leadership. Industry insiders note that Intel’s delays in 7nm production, setbacks in AI hardware deployment, and dependency on foreign supply chains are weakening its competitive edge.

Trump’s criticism may have inadvertently highlighted these growing weaknesses, bringing public attention to Intel’s challenges in staying relevant in a rapidly evolving tech landscape.

The Bigger Picture: Economic Nationalism and Silicon Sovereignty

Trump’s remarks are also seen as a broader attack on corporate globalization, a theme consistent with his previous policies during his presidency. By framing Intel’s CEO as “outsourcing America’s future,” he is attempting to rally nationalistic support for a new wave of economic protectionism—particularly in industries deemed critical to national security.

Intel’s current strategy, which includes overseas partnerships and multi-national production nodes, now stands at odds with this rising narrative of “America First” tech manufacturing.

If Trump returns to office—or even maintains political momentum—Intel and similar firms may face increased pressure to localize their operations, potentially at the cost of efficiency and profit.

Shareholder Concerns: What’s Next for Intel Investors?

With the political spotlight firmly on Intel, shareholders are navigating murky waters. The key questions being asked are:

- Will further political attacks continue to erode public trust in Intel’s leadership?

- Could government contracts or incentives be withheld due to perceived misalignment with national interests?

- Will Intel pivot its strategy in response to political pressures?

Financial advisors are urging long-term investors to monitor developments in Washington closely and to watch for shifts in corporate governance or policy compliance.

Conclusion: Intel Faces a Critical Crossroads

As Intel contends with a rare and damaging intersection of politics and business, its leadership must now focus on rebuilding investor confidence, strengthening its core business, and navigating an increasingly politicized operating environment.

While the stock may recover in the short term, the reputational scars and strategic implications of Trump’s explosive rebuke could echo well into the future.

Intel’s next earnings call, expected later this quarter, will be closely scrutinized by analysts, media, and policymakers alike. Any misstep could invite further backlash—both from investors and from those in power.

If you want to read more information about how to boost traffic on your Website just visit –>click

1 thought on “Intel Stocks Plunge Amid Trump’s Public Rebuke of CEO”